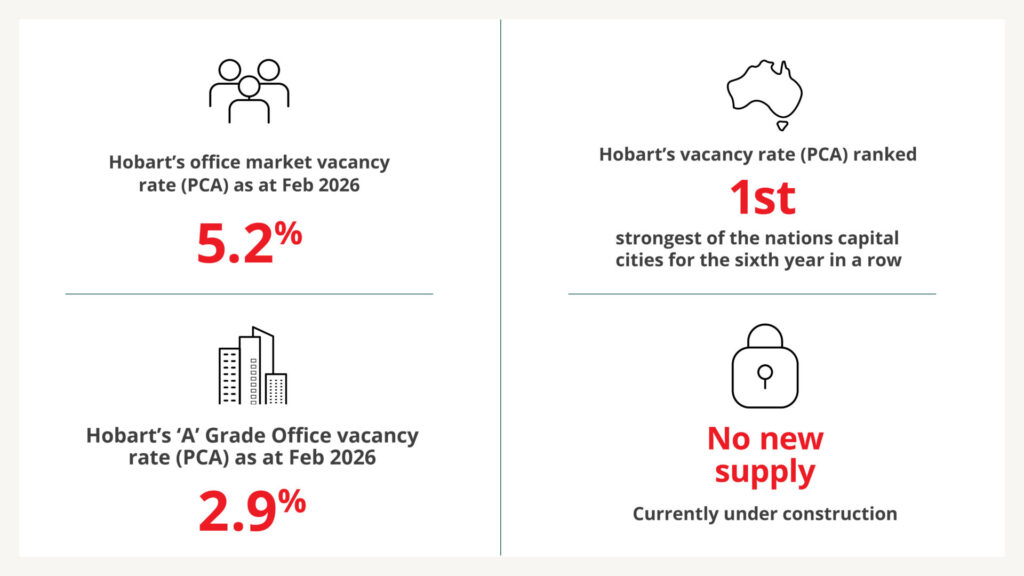

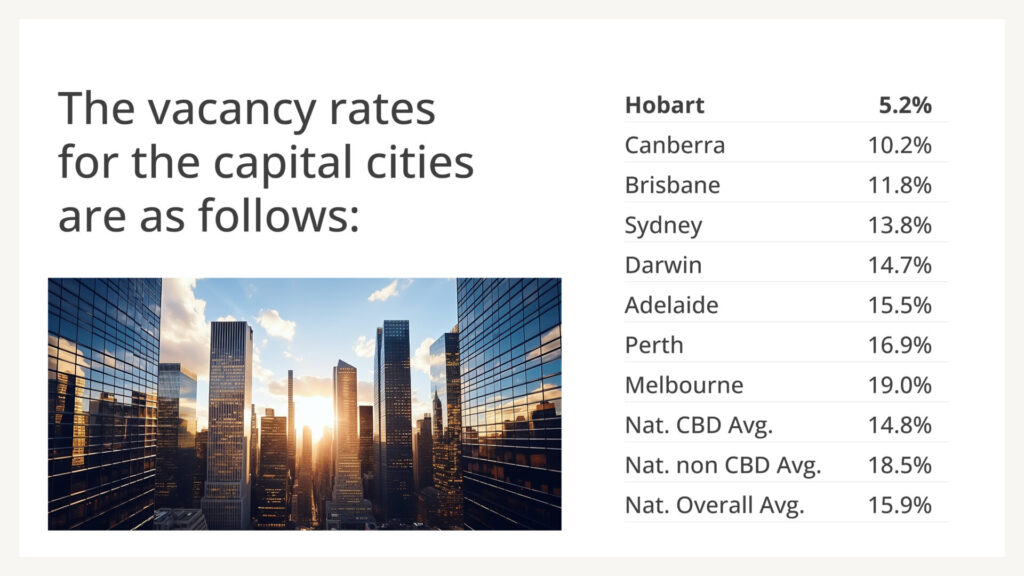

Hobart continues to deliver the strongest capital city office market performance in Australia, leading the country for the sixth consecutive year. According to the Property Council of Australia’s Office Market Report (February 2026), Hobart’s vacancy rate sits at just 5.2%, up slightly from 3.6% last year yet still materially tighter than every other capital city market and well below the national average of 15.9%.

The Hobart CBD office market comprises approximately 353,745 square metres of total stock and has historically been characterised by demand led supply. New developments have typically proceeded only where major tenant precommitments are secured, with virtually no speculative construction due to the economic rent required to justify development. This supply dynamic has underpinned persistently low vacancy rates and is expected to remain supportive given there is currently no new supply under construction or anticipated in the short term.

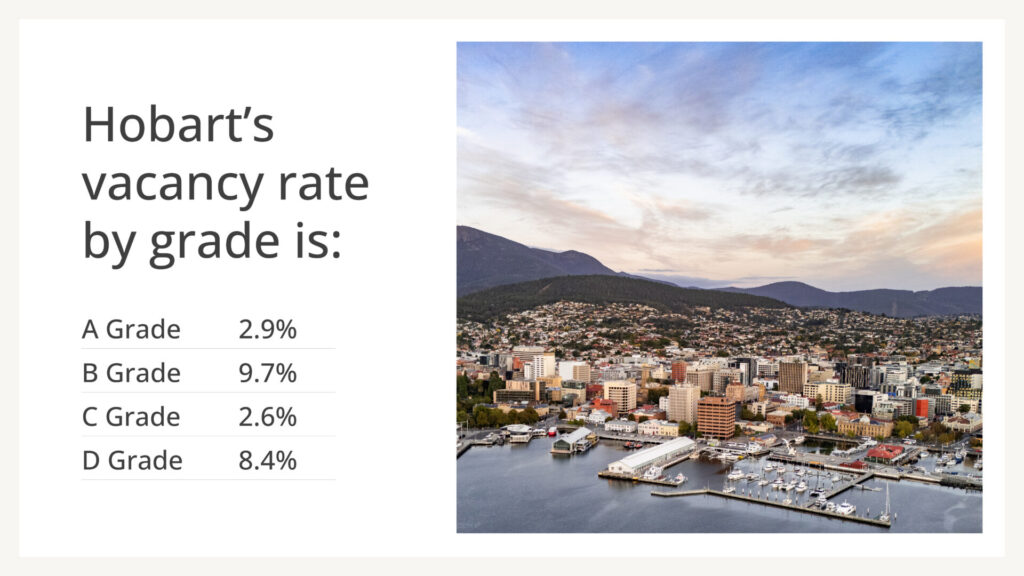

Over the past few years, the market has also displayed a pronounced “flight to quality.” This is evidenced by an “A” grade vacancy rate of a mere 2.9% compared with 9.7% in the “B” grade sector. Tenant expectations have elevated in response to regulatory requirements and shifting workplace priorities, including improved employee satisfaction and engagement. These factors have intensified demand into higher quality buildings, further reinforcing the superior performance of well-presented properties.

Outside the CBD, Hobart offers very limited office alternatives, with most established precincts effectively full with minimal relocation options for tenants. This scarcity has supported rental growth and helped keep incentives comparatively low in recent years.

The market remains relatively tightly held, with owners benefiting from solid income growth that has largely offset any potential softening of yields. Notably, two major office transactions occurred in 2025: 22 Elizabeth Street (NLA of approx. 10,703 sqm, predominantly leased to the State Government) was acquired by an interstate private investor, while 47 Liverpool Street (NLA approx. 4,665 sqm with a short WALE) was purchased by a private developer considering potential conversion to alternative uses.

Against this backdrop of robust fundamentals and pricing levels that sit considerably below replacement cost, investor interest in Hobart office assets remains strong. At the sub $2 million level, the market continues to be driven primarily by owner occupiers.