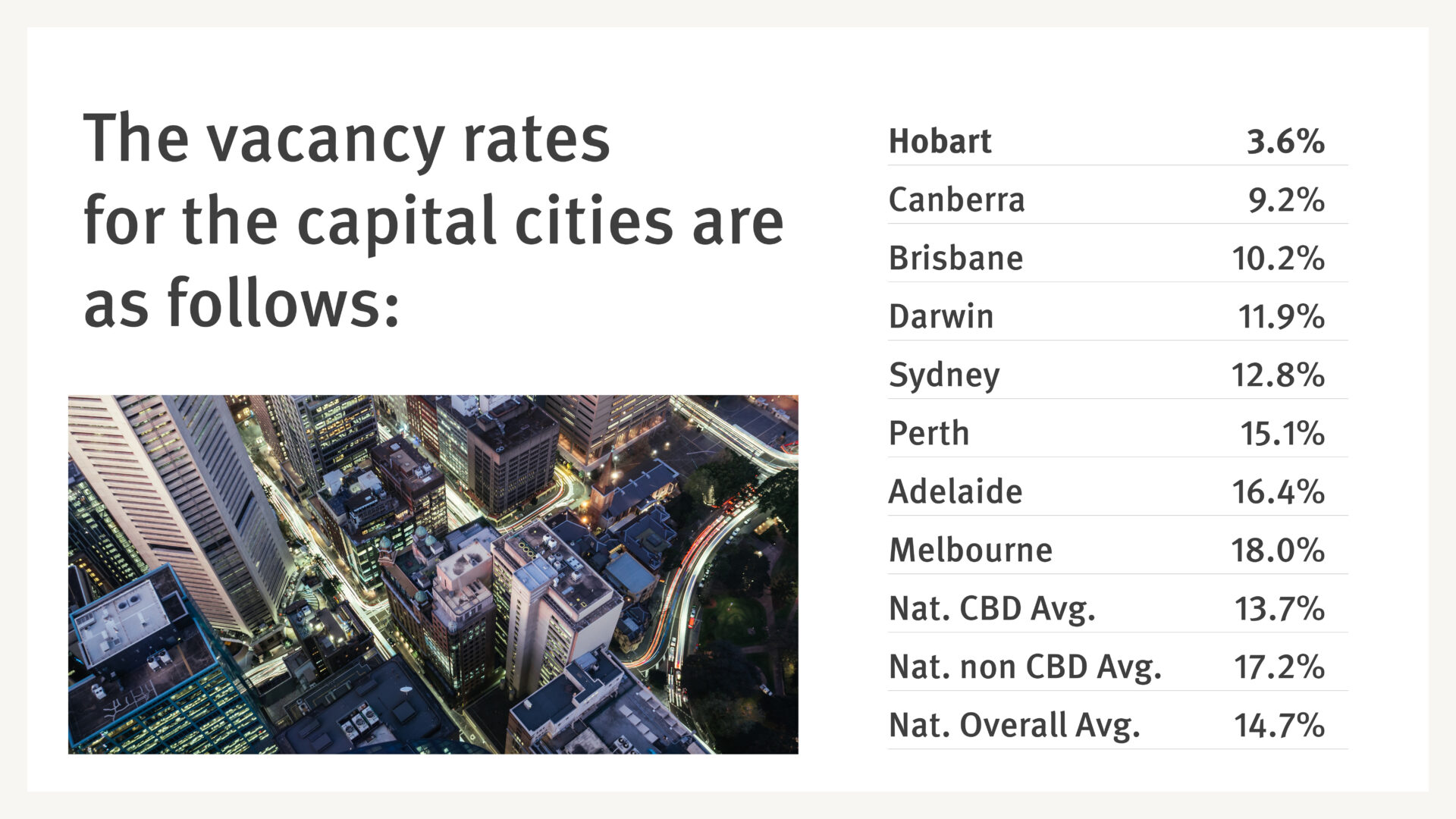

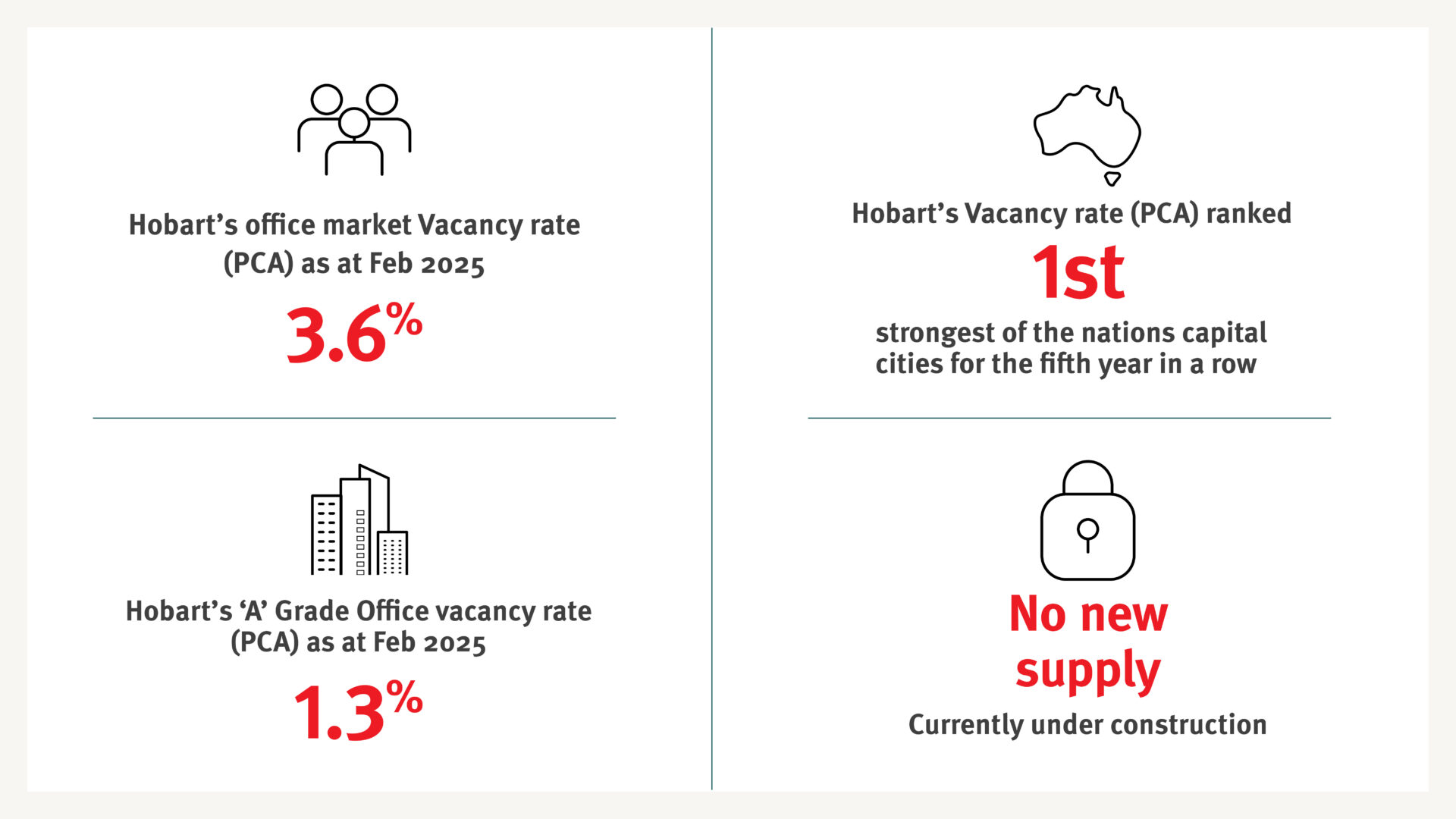

According to the Property Council of Australia’s (PCA) Office Market Report (February 2025), Hobart has the strongest capital city office market in the country for the fifth year in a row with a vacancy rate of a mere 3.6% slightly up from 2.8% last year. It is well clear of any other capital city market and the national average of 14.7%.

Hobart’s total CBD office stock is 353,216 sqm and historically new supply within Hobart’s market has been demand driven, with new office accommodation primarily resulting from pre-commitment by major tenants, with virtually no speculative development as a result of an economic rental required to support development. This has assisted in the market maintaining a low vacancy rate, which is likely to continue for some time with no new supply currently under construction or expected in the short term.

Hobart has the strongest capital city office market in the country

Over the past 12 months there has been a flight to quality, as evidenced by the “A” grade sector vacancy rate firming to 1.3% whilst all other grades experienced a softening. Tenant demands and expectations have been elevated in recent times to meet regulatory requirements and improved employee satisfaction and engagement, resulting in this flight to quality.

There is very little office accommodation outside of Hobart’s CBD, with all bases essentially full and limited options for tenants to relocate to. As a result, this has driven rental growth over the past few years and kept incentives at a low level.

Hobart’s “A” grade sector vacancy rate firming to 1.3%

Given Hobart’s strong office market fundamentals, with existing property owners experiencing solid returns in recent years off the back of rental growth which has essentially offset any softening in yields, Hobart’s market has been extremely tightly held with no major transactions occurring in the past 12 months.

The most recent major transaction was Terraplex’s purchase of the “Lands Building”, 134 Macquarie Street, Hobart for $57.5 million in December 2023. There are however a number of parties seeking opportunities to invest in Hobart’s office market. The sub $2 million office market has continued to be driven by owner occupiers.

With no new supply in the near future and a likely further withdrawal of older stock, we forecast the market stock level to reduce further over the next 12 months and the flight to quality to continue. Along with the return to work, prohibitive construction costs, and all “bases loaded”, the vacancy rate is likely to continue to remain extremely low for many years to come, continuing to drive rental growth and maintain a low incentive environment.

For more information about Hobart’s office market conditions, or to discuss the sale or lease of your office asset, please contact Richard Steedman for a confidential discussion.